For nearly a decade I owned owned some Premium Bonds. They’re a savings type thing but instead of receiving interest, you get a chance to win a large, juicy chunk of tax free money every month. In theory, when times are good, they can outperform traditional savings on average. You get one chance per squid you have “invested” up to a limit of thirty thousand squids. I have nowhere near that number but, even so, by the laws of probability I should be making enough for a bottle or three of wine a year with the secondary luxury of having a little bit stashed away that I often forget about. It turns out I had completely forgotten about them because I have never, ever won a single dime. Not a sausage. Not even a smell of sausage. Indeed, I actually phoned them to check a couple of years back because it seemed outrageous that after shaking the dice that many times I had not come up with a single six.

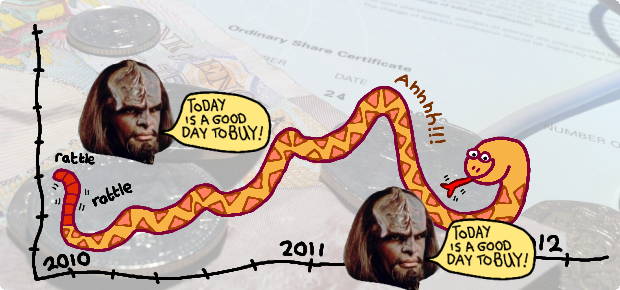

So I thought, bugger this, I can do better in shares. After all, it’s a crap time in the stock market so the only way is up! Obviously, I would not recommend taking investment advice from a bunch of cobras like me, but I used some simple rules:

- No namby pamby ‘Business model? Yeah, web five point oh’ type gubbins. The Market seems to be nicely set up for another .com bubble pop and I didn’t want to take part in that

- Absolutely no bricks and mortar retail operations. Traditional retail is on the way out and it is too challenging for me to predict those that will adapt successfully and those that will not

- Companies that have been around for a while and show a general tendency for growth over a number of decades and trade in things that are unlikely to vanish overnight

- Pick on companies that have actual assets that are actually worth something and are currently undervalued for whatever reason

I call this approach “Bad News Trading” and the worse the news, the better. Unless I accidentally pick an Enron, some shares are trading seriously below their real value right now and have done on several occasions since greed-motivated economic melt-down a few years back (oh, and this is worth a read, by the way).

So, fancying some greed of my own, I started looking at some shares. I read books, newspapers and magazines, did some research on the Internet and started to get familiar with a few organisations. I began with an imaginary portfolio and did so well that I just HAD to try it with real money. And so, last summer, I took the small amount of money I had in Premium Bonds and started slapping it into some companies. I picked four in the end: one bank, one oil company, a mining company and a food company that own a good stack of brands that I knew and loved.

Several roller coasters later, my “portfolio”, if one can call it that, has been as high as 50% up and as low as 15% up (that was earlier is week, you won’t be surprised to hear). The best bit, though was when I received my first dividend cheque. It might only have been a tenner but it is by far the most satisfying tenner I have earned in years. On top of that, their shares continue to climb at a healthy rate and look like returning to levels last seen before the global economic difficulties… and that is even after the past week of grimness! Ok, fair’s fair, my bank investments have not gone so well, but there’s still hope!

I am well chuffed. I’ve outpaced the best that a savings account could have paid by an order of magnitude. I plan on keeping these babies for at least another year, maybe more and needless to say I couldn’t let an economic catastrophe like this week’s pass without making another small investment. Clearly, the quality of my advice can go down as well as up and I am regulated only by red wine and home-made schnapps so I seriously don’t recommend that you accidentally treat this as investment advice but it does seem like a more educated gamble than, say, the lottery, horses or a casino. We’ll see. In the meanwhile, I have another dividend cheque to deposit! Woohooo!

Pingback: Atishoo, atishoo, their pants fall down | Cobras Cobras